Travel Guidelines

The State of New York Office of the State Comptroller (OSC) and SUNY policies govern official travel and travel reimbursement. Actual and necessary expenses while in travel status supported by receipts and established per-diem rates for lodging and food may be reimbursed.

All travel reimbursement is subject to supervisory approval and availability of funds.

At times, travel may be funded through Research Foundation grants. As a legally independent corporate entity, the Research Foundation is not required to comply with New York State policies, but rather adheres to sponsor mandates. Wherever practical, Research Foundation travel guidelines parallel those of SUNY and are described separately in the Project Director Guide issued by the RF Fiscal Department of the Business Office.

Airline Ticket Purchases

A traveler should secure an airline ticket by price checking multiple airlines for the times and dates of travel to get the best price available and will need to charge the cost of the airline ticket to their personal credit card. Travelers should ensure that the pricing they are getting is for a similar ticket including same departure and return times, same travel routes, refund capability, etc. Documentation should be printed at time of booking to submit with reimbursement voucher.

A travel advance may be requested up to four (4) weeks prior to the anticipated date of the airline ticket purchase to reimburse the traveler for the airfare costs charged to their personal credit card. The traveler should send a completed and approved Travel Authorization form to the Purchasing and Accounts Payable Office to secure the advance.

Note: The State will not pay for the following:

-

- Any extra services, such as seat upgrades, travel insurance, priority boarding, more than one piece of checked luggage on domestic flights, and two on international flights. Flights should be booked from the most cost effective airport and not based on personal preference.

- Additional fees associated with incorporating a personal trip around your work travel.

- In this instance, include estimated pricing for what the trip would have cost if you were not including personal travel (for example, if the conference dates are 9/12-9/15, but your extended stay is through 9/22, include an estimated airfare quote (a screenshot is acceptable) for 9/12-9/15 (depending on when you would have left) along with the actual costs. The State will pay the lessor of the two options.

- Another instance that is non-reimbursable, is to leave multiple days prior to the start of the conference/meeting. You may be reimbursed up to one day ahead of the conference/meeting (for travel time).

- For example, the conference starts Monday, but you fly out on the Saturday before. If it's more cost effective, you will be reimbursed as if you left on Sunday (considering the following: additional meals and lodging for the extra day (Saturday)). Be sure to include an estimated airfare quote (a screenshot is acceptable) for this.

- Additional justification should be included with your Travel Authorization Request.

- For example, the conference starts Monday, but you fly out on the Saturday before. If it's more cost effective, you will be reimbursed as if you left on Sunday (considering the following: additional meals and lodging for the extra day (Saturday)). Be sure to include an estimated airfare quote (a screenshot is acceptable) for this.

The above procedures apply to: State operations, DIFR (Dormitory Income Fund Reimbursable), IFR (Income Fund Reimbursable) accounts, and joint committee awards (JDA, IDA, DRESCHER, etc.).

- Exclusions: Research Foundation, ASC, and College Foundation

For any questions please contact the Purchasing and Accounts Payable Office at ext. 2306.

Authorization for Travel and Travel Authorization Form

Campus authorization to travel is required for official State business, whether or not cost reimbursement will occur. This provides proper documentation to show that the trip was authorized, and it protects the employee in the event of incident.

The traveler must complete a Travel Authorization Form stating destination, travel dates, purpose of travel, account code to be charged, and other necessary information. This is necessary even if no reimbursement will be requested.

- The form must be completed by the traveler, signed by the appropriate supervisor & Dean/VP, and forwarded to Purchasing and Accounts Payable Office prior to travel unless there is an item for special consideration, as noted below.

*If you have not received your final approved travel authorization prior to your trip, please check with the Travel Office at travel@cortland.edu.

Items for Special Consideration

In cases of non-overnight, local travel (under 35 miles) incidental to on-campus activities, often of an unscheduled nature, it may be impractical to process a formal Travel Authorization Request. In this circumstance, it is suggested that notification to one's immediate supervisor occur to document the official nature of the travel in protection of the individual.

Examples:

- to libraries for research/classroom materials

- to local retail/wholesale establishments (ex. Wal-Mart)

- fieldwork collecting for classes and research

- presentation of a lecture if part of direct University responsibilities.

Travel occurring while on leave (sabbatical, etc.) or during non-obligation periods (ex. during intersessions/spring breaks/summers) would normally be considered personal and therefore exempt from this procedure unless a direct University responsibility. Similarly, jury duty or other compensated activities normally are considered personal and exempt from this procedure.

Please allow at least two (2) weeks processing time for the travel authorization before your scheduled departure date.

If you have any questions, please reach out to the Travel Office prior to submitting your Travel Authorization Request, to avoid errors and resubmissions.

Hierarchy of Vehicle Usage Flowchart

Car Rentals

Per OSC Travel Manual, "If available, State vehicles should always be considered when the use of an automobile is required."

Hierarchy of Vehicle Usage Flowchart

OGS Trip Calculator How-to Video

- Link to Enterprise online renting for government employees

Traveler should use the OGS Trip Calculator to determine whether a personal or rental vehicle is the most economical means of ground transportation to use (reimbursement will not exceed the OGS Trip Calculator).

IMPORTANT: Car rentals should only be made for SUNY Cortland employees.

What you need to know when renting a vehicle using the NYS contract:

- Always rent under the State of New York Contract by utilizing the SUNY Cortland account.

- Non-employees may ride in the State rented vehicle only if on official State business with the State employee renting the vehicle. It is important to formally establish the official business nature of the travel, prior to departure, by completing a fully-approved Travel Authorization Form. Non-employee classification would fall into the below status categories:

- leave status

- student status

- Research Foundation employment status

- volunteer status (if not provided a "C" number from HR)

- campus visitor status

- Insurance

- The rental company must provide New York statutory liability limits of insurance in the amount of $25,000/$50,000/$10,000, plus statutory uninsured motorists a no-fault coverage.

- Neither you nor your employer are authorized to purchase any additional insurance when renting a vehicle in New York State.

- In the event of a serious accident where the basic limits are exhausted, the State employee would be defended and indemnified under Section 17 of the Public Offenders Law subject to the conditions contained therein.

- If the rental vehicle is damaged, the State is responsible for a maximum of $100 to private passenger vehicles (including mini vans) and full value for commercial vehicles such as large vans and trucks. In the event you pay the $100, OGS will reimburse you through the Bureau of Insurance, with appropriate documentation.

- If more than one employee will be driving the vehicle, additional drivers must be listed on the rental contract. The State should not pay additional charges for these drivers. Unauthorized persons should not be allowed to drive the vehicle.

- Rentals should be Compact/Economy size.

- If Standard/Intermediate/Full-size are used, written justification must be provided with invoice/PO.

- If you feel that you need a larger vehicle than those mentioned above (due to multiple passengers, etc.), please contact the Travel Administrator at x2306 for prior approval and include justification.

- Failure to obtain prior approval will result in the traveler paying the difference of the larger vehicle out of their own pocket.

- Charges & Violations

- The operator of a State rented vehicle is personally responsible for payment of any traffic violations, E-ZPass violations, and/or damage caused to the vehicle by careless and/or reckless driving while in possession of a State rented vehicle.

- E-ZPass tolls can be paid with a p-card to the rental company.

- Any gasoline purchases/refills and other direct costs associated with the rental vehicle will be reimbursed with receipt or direct billed to the university. Reimbursement for personal car mileage when using a rental vehicle will not be allowed.

- Employees who utilize rental vehicles for personal use must reimburse the State for the cost of any charges incurred as a result of such personal usage.

- If Traveler elects to have Enterprise refuel the vehicle upon return, it will come at a premium cost to their department's budget.

***If there is a last-minute cancellation by the rental car agency, please contact the Travel Administrator at x2306 for assistance.

Vendor Options

New York State currently has an exclusive agreement with Enterprise and Hertz Car Rental, which offers discounted rates to all State employees on official business.

Hertz

The Purchasing and Accounts Payable Office must process reservations on your behalf. Please contact Kathy Timian at x2306 with reservation information.

Hertz Locations

To be able to use the direct bill option, you will need to rent at these locations:

Vestal/Binghamton - 2520 Vestal Parkway East, Vestal, NY, 607-729-2406

Syracuse - 1216 Burnet Ave., Syracuse, NY, 315-426-0936

Cicero - 7885 Brewerton Rd., Cicero, NY, 315-452-3217

There is a location in Ithaca that will honor the state rates, but they are not able to direct bill the rental to the college. These would have to be reimbursed to the employee.

Ithaca - Tompkins County Airport, 1 Culligan Drive, Ithaca, NY, 607-257-8677

For airport locations, you can get the state rate although there is an airport fee. For example, at Ithaca the cost of the rental would be $31.90 for a compact size car, but at Vestal/Syracuse/Cicero it would be $29.00. Some airport fees are more expensive; it depends on the rental location.

Enterprise

Reservations can be set up independently.

Please contact Kathy Timian at x2306 for the Campus account number and billing number to ensure direct billing.

When making the reservation, online is preferred, but if calling the local office, be sure to have the agent reference your name or your department on the reservation. Your department Red Dragon Depot (RDD) account holder will create a PO and attach the invoice for processing.

Enterprise Locations

Cortland - 991 State Route 13, Cortland, NY 13045, 607-758-9000

Vestal/Binghamton - 2909 Vestal Rd., Vestal, NY 13850, 607-797-0900

Ithaca - 803 Cascadilla St., Ithaca, NY 14850, 607-275-9000

Camillus - 3696 Milton Ave., Camillus, NY 13031, 315-424-3043

East Syracuse - 6716 Manlius Center Road, East Syracuse, NY 13057, 315-437-2666

Syracuse - 637 W Genesee St., Syracuse, NY 13204, 315-423-0022

North Syracuse - 3605 Brewerton Road, North Syracuse, NY 13212, 315-454-3000

Cicero - 8072 Brewerton Rd., Cicero, NY 13039, 315-233-5382

Clay - 8395 Oswego Road Unit 5, Liverpool, NY 13090, 315-652-2103

FAQ's

Passenger Vehicle Rental Frequently Asked Questions

How does the Car Rental Program work?

The state has secured discounted, contract rates with Enterprise Rent-A-Car and Hertz Rent-A-Car. An account and billing number must be provided to reservation agents in order to guarantee the state rates. Please call the Purchasing and Accounts Payable Office at ext. 2306 to get the account number for direct billing prior to making reservations.

Note: No non-state employees may rent vehicles using State Price agreements. However, a campus staff member can rent a vehicle for a candidate. The rental cannot incur more days than the interview would cover. (In a case where a candidate would like to stay extra days for personal time.)

Who can rent and operate vehicles under the State Price Agreements for vehicle rental services?

Any state employee (including from another SUNY institution) or authorized users may operate the vehicles. Non-state or non-authorized user employees may not rent vehicles using this agreement. The primary reason is the liability involved for the person driving the vehicle, the contractor, and the State. Our OGS agreement includes full damage and liability insurance coverage and if a person was involved in an accident operating a rental vehicle, and it was discovered that the person was not a state employee or authorized user employee of the State, the State could ultimately end up being responsible for a non-state employee or non-authorized user accident.

Why do I need a credit card when renting a car?

Car rental companies, nationwide, require this of ALL customers. This is for their protection when renting a car to an individual. However, Enterprise and Hertz will provide agencies that have a documented need with agency direct billing accounts. All charges are accumulated and billed to the agency’s account. In this case, a credit card will not be required as Enterprise and Hertz have the agency’s account information on file.

Do I need to buy the extra insurance when renting a car?

No. The Enterprise and Hertz contract covers ALL damage occurred while using the car rental contract.

What is the insurance coverage for renting cars in foreign countries?

The insurance coverage for car rentals in foreign countries varies from country to country. Please contact your finance office to verify the type of coverages that are available for the countries you are traveling to and to determine if you will need to purchase additional insurance from the car rental company.

What is the mileage limit under the car rental program?

Unlimited miles, although you must pick up and drop off the car at the same location.

What if I need to drop the car off at a different location?

No additional fees apply for one-way rentals within 500 miles of the renting location. For one-way rentals greater than 500 miles, Enterprise will charge a flat rate of $65 per day. Hertz charges $125 per rental for all one-way rentals exceeding 500 miles. Reservations should be requested in advance to drop-off at a different location.

Do I need to be over 25 to rent a car?

No, the state contact allows drivers 18 and older to rent a vehicle. Vehicles should only be rented by state employees.

Car Rental Confirmation Numbers

It is recommended that you take the Car Rental Confirmation Number with you when you are going to pick up the rental. This will expedite the rental process.

Please contact Kathy Timian at 607-753-2306 with any questions.

Please call the Purchasing and Accounts Payable Office at ext. 2306 to get the account number for direct billing prior to making reservations.

Conference Registration Fees

Registration fees for conferences should be paid directly by the department P-Card holder (pending prior approval, if applicable). If a credit card is not accepted, a purchase order should be submitted as soon as possible for processing (see your department/office Administrative Assistant for assistance).

Traveler will provide department Administrative Assistant with appropriate backup documentation, such as, account to be charged, event, dates, and type of registration needed (ex. number/which days, hotel/motel included/not included option, in-person/virtual, etc.). Administrative Assistant (P-Card holder) requires this documentation to be included with reconciliation of their P-Card or Purchase Order creation.

*Note: Actual payment for a registration fee via purchase order cannot be processed until after the conference is held. Conference attendees should check at the point of making arrangements to attend if a purchase order will secure registration.

Day Trip Meal Reimbursement

Employees on business trips lasting one day or less, but more than 35 miles from their official station and place of residence, may be eligible for meal reimbursement.

Based on departure and return times, travelers are entitled to reimbursement for breakfast if they have to leave at or before 7:00 AM, and/or for dinner if they return at or after 7:00 PM.

The current day trip meal reimbursement rates are as follows (no meal receipts required):

Breakfast - $5.00

Dinner - $12.00

(Lunch is never reimbursed)

Note: Day trip meal reimbursements are reportable as income to the IRS and are subject to withholding taxes.

Foreign Travel

Individuals traveling abroad on official business must adhere to all of the previously mentioned guidelines with regard to travel authorization (which needs Provost/VP approval), advances, and receipt requirements. Per diem rates for foreign travel follow the rates established by the Federal government in the Maximum Travel Per Diem Allowances for Foreign Areas published monthly.

The foreign travel rates provide for lodging costs up to a maximum amount and an allowance for meals. If a traveler is not entitled to the full per-diem, the meal allowance is divided into 80 percent (80%) for dinner and 20 percent (20%) for breakfast.

Travelers to foreign countries should document the exchange rate for the applicable foreign currency during the dates of travel, because conversion to American dollars is required for reimbursement. These exchange rates are later verified by the Purchasing and Accounts Payable Office when the travel voucher is processed.

**For assistance translating documents, we suggest taking a picture of the receipt and use the Google Lens app to translate. Then print and keep the translated document with the original to provide with your final travel voucher paperwork.

Look for Lens in the search bar of the Google app.

Upload your picture.

Click Translate and print.

Hotel Reservations

Hotel reservations are normally made by the traveler or the department/office Administrative Assistant. Hotels/motels within New York State should be advised that the business travel is sales tax exempt and that a Tax Exemption Certificate will be provided. "State Rates" should be requested.

It is highly recommended the traveler register with the hotel and book online. Request "State/Government Rates" when booking to reduce the need for an Over-the-Max Request form in some instances.

The traveler must obtain an itemized receipt in order to gain reimbursement.

Use caution when using third-party booking sites (ex. Expedia, Travelocity, etc.). Be sure to log into your account to retrieve an itemized invoice (as one won't initially be provided in the your emailed receipt).

Intercollegiate Athletics Travel

These guidelines are supplemental to SUNY Procedures and are to be filed with the New York State Office of the State Comptroller (OSC).

The following procedures are fully approved by the State University of New York College at Cortland Intercollegiate Athletics Board (CIAB):

- To provide for consistency of expense reimbursement under team travel, the required times for departure from and return to Official Station to justify a full per-diem reimbursement shall be waived (i.e., 7:00 AM, 7:00 PM).

- The maximum allowable Method I and Method II per-diem rates are established at the prevailing New York State Method I and Method II rates. However, per-diem reimbursements may be lower by CIAB determination and availability of resources.

- Coaches' travel expense reimbursement will adhere to prevailing New York State and bargaining unit rates and guidelines.

- Team coaches may utilize their Athletics' NET cards for lodging, meals, and emergency vehicle repairs. Customer receipt copies must be retained by the coach for submission to the Purchasing and Accounts Payable Office for payment.

Job Candidates

Division of Academic Affairs

Airfare for Job Candidates

Commercial Transportation (airfare, rail fare, etc.):

For faculty-related searches and all other searches financed by the Provost’s Office, candidates will cover their air travel costs and be fully reimbursed. Please contact the Provost’s Staff Assistant at ext. 5421 regarding payment of bills. For more detailed instructions and procedures, view Procedures for Direct Billing and Reimbursement (PDF).

As part of reimbursement of air travel, campus contacts will advise candidates about finding the most cost effective airline by ensuring the pricing they are getting is for a similar ticket including same departure and return times, same travel routes, refund capability, etc.

Travel reimbursement to candidates is processed using a Standard Voucher (also found on the Purchasing Accounts Payable Office Forms website).

If you have any questions regarding the above procedures, please call the Purchasing and Accounts Payable Office at ext. 2306.

Lodging for Job Candidates

Reimbursement of travel expenses will be allowed only to persons residing more than 50 miles from the interview site. Expenses may include transportation (e.g. mileage), food, and lodging.

The following procedure is to be used to secure local lodging for interview candidates, expedite payments to lodging vendors, designate the name of the candidate, and certify tax-exempt status.

Please Note: For faculty-related and all other searches that are financed by the Provost’s Office, please contact the Provost’s Staff Assistant at ext. 5421 regarding payment of bills.

Note: Candidates are expected to pay for all telephone calls, cable-movie rentals, and all other incidental charges at the time of checkout.

- The campus departmental representative making the lodging arrangements for the candidate determines the date(s) for which lodging is required and the lodging establishment to be used.

- The departmental representative then contacts the hotel/motel and makes the reservations noting the candidate's name and date(s) needed. The department representative should confirm the New York State government rate will be charged and remind the hotel/motel that this charge is to be tax-exempt and verify campus will be billed for the charges advising them to send the invoice to accounts.payable@cortland.edu referencing the department reserving the room.

- The department then completes a PO in Red Dragon Depot for the lodging charge total stating the name of the candidate and the number of days of stay. If the candidate will be eating a meal at the hotel/motel, an amount for that meal (not to exceed the prevailing meal per diem for Cortland County) may be listed on the PO and added to the lodging amount to arrive at the total (invoice must be itemized).

- The completed PO is electronically forwarded through Red Dragon Depot (RDD) for appropriate approvals.

Please Note: The following hotels have agreed to accept Purchase Orders and bill the University for candidate lodging charges:

Quality Inn

188 Clinton Ave

Cortland, NY 13045

607-756-5622

Fairfield by Marriott Inn & Suites

3707 Route 281

Cortland, NY 13045

607-299-4455

Ramada Cortland Hotel & Conference Center

2 River Street

Cortland, NY 13045

607-756-4431

Meals for Job Candidates

Meal Allowances, per the President's Cabinet, the allowable rates for candidate-related meal expenses are as follows:

- Breakfast: $13/person

- Lunch: $18/person

- Dinner: $35/person

Exceptions to this policy apply to searches for members of the President's Council or at the discretion of the appropriate vice president.

Payment of Meal Costs

- Meal costs related to candidate interviews must be for no more than the candidate plus two (2) University interviewers. Costs should be limited to the extent possible.

- Requests for payment of meal costs cannot include tax or alcohol and no more than 20% added for tip. (New York State does not consider alcoholic beverage costs an appropriate State expense.)

- For restaurants agreeing to direct bill, the responsible interviewer may sign for the bill and promptly forward the original itemized invoice along with a completed purchase requisition through Red Dragon Depot to the Purchasing and Accounts Payable Office for direct vendor payment. At the time reservations are made, check to see that direct billing will occur.

- NOTE: Each PO must contain the names of the interview candidate, the University interviewers, the title of the position being interviewed, interview agenda, the date of the meal, and an itemized statement from the appropriate restaurant.

- For restaurants not willing to bill the campus, the responsible interviewer will make personal payment and forward the original itemized receipt along with a completed Standard Voucher through the proper channels for signatures and account coding to the Purchasing and Accounts Payable Office for reimbursement to the individual.

- Per Office of the State Comptroller (OSC) Bulletin G-78, the following criteria apply (in case of OSC disapproval, the liability may rest with the individual employee):

- The interview process which includes a necessary meal period must be of benefit to the University.

- The cost of the meal must be at the lowest reasonable and feasible amount.

- Only University employees essential to the interview process may incur meal expenses in addition to the candidate.

- Alcoholic beverages cannot be included.

- A candidate may not additionally receive reimbursement for the same meal through any standard voucher process.

- An itemized receipt (restaurant, etc.) is to be submitted as substantiating documentation.

Official Business

To protect the traveler and the institution, it is important to establish the official business nature of the travel prior to departure, whether or not costs are reimbursed. Unless formally stated elsewhere (specific reference in performance program, etc.) a fully approved Travel Authorization Request is necessary to satisfy this requirement.

Active New York State employee status normally demonstrates official business activity. However, official business may occur while in leave status, student status, Research Foundation employment status, or volunteer status. In these circumstances it is especially important to formally establish the official business purpose and authorization for travel.

The Purchasing and Accounts Payable Office administers travel and may be contacted regarding any of these guidelines at ext. 2306.

Official Station

In accordance with New York State Accounting System Procedures, Volume XI, Section 3.0600, Page 2, SUNY Cortland is to designate the official station for all employees for the purposes of official travel and reimbursement, in the best interest of the State.

Except when otherwise designated, all SUNY Cortland employees will have as their designated official station SUNY Cortland Main Campus, Cortland, New York 13045.

Some University employees whose primary and ongoing official work site is other than the main campus may have an official station designation as that work site. In some cases, a person's legal residence may be designated as official station so long as that residence is at least 35 miles from the main campus or branch campus site of SUNY Cortland, and no regular attendance at a main or branch campus is required as a condition of employment.

Official Station, as defined by SUNY Cortland:

- If you work at the SUNY Cortland campus or have a workstation designated at the Cortland campus, then your official station is SUNY Cortland.

- If you do not work at the SUNY Cortland campus at all and do not have a workstation designated at the Cortland campus, then your official station would not be the Cortland campus.

To have an assigned official station other than the main campus, the supervisor of the employee should designate in writing, gain the respective Vice Presidential approval, file with Human Resources, and advise the employee.

Employees should make note on their Travel Voucher if their official station is anything other than SUNY Cortland.

When in travel status, the designated official station shall be used in all time and reimbursement calculations, except that when travel commences from an employee's residence, the departure point shall be the residence or official station, whichever is closer to the destination. In this way, only actual costs will be reimbursed consistent with policy and tax law intent.

No transportation costs will be allowed between any employee's home and his or her official station.

NOTE: To be eligible for reimbursement of meal and lodging expenses, the traveler must be in continuous travel at least three hours with a destination greater than 35 miles from the employee's residence and official station.

Overnight Travel Reimbursement

When an employee is in overnight travel status, reimbursement for lodging and meal expenses can be made using one of two methods:

Method I (Unreceipted/Flat Rate)

This method provides for a flat rate allowance for meals, lodging, and incidental expenses regardless of where lodging is obtained (including lodging with relatives or friends). No receipts are required. To be entitled to the full per diem, you must be in overnight travel status and eligible for both breakfast and dinner.

| Location | Per Diem |

|---|---|

| New York City and Nassau, Suffolk, Rockland and Westchester Counties | $50.00 |

| Cities of Albany, Binghamton, Buffalo, Rochester, Syracuse and their respective surrounding metropolitan areas | $40.00 |

| All other locations in New York State | $35.00 |

| Out of State (includes any out of state tax on lodging) | $50.00 |

Travelers using this unreceipted method are also eligible for an additional $5.00 for breakfast on the day of departure if they leave at or before 7:00 AM. They are also eligible for an additional $12.00 for dinner on the day of return if they return at or after 7:00 PM.

Method II (Receipted/Actual)

This allows for reimbursement of actual lodging costs up to a specific amount, plus an allowance for meals. The federal domestic per diem amounts are based on the area of your work assignment and are revised annually (every October 1st). The breakdown of the meal per diem rates listed on the GSA website can be found at the SUNY Blue Travel Center Meals and Lodging website.

- Receipts are required for lodging.

- No receipts are required for meals.

For each day the traveler is in overnight travel status, the traveler is eligible for reimbursement for lodging, up to a maximum lodging per diem, and a per diem allowance for meals. The meal per diem is for dinner the first night and breakfast the following day.

Travelers using this method are also eligible for an additional per diem for breakfast if they leave at or before 7:00 AM on the initial day, and/or an additional dinner per diem if they return at or after 7:00 PM on the last day of travel. In these cases, breakfast and/or dinner will be reimbursed up to the maximum amount of the meal per diem allowance specified for the particular area of lodging.

The reimbursement amounts are based on rates established by the U.S. General Services Administration and are established by the county your lodging is in (which may be different than where the conference/meeting is being held).

No taxes should be paid within New York State. For travel within New York State, a Tax Exemption Certificate (ST-129) should be used. For out-of-state travel, local and state taxes will be reimbursed in addition to the per diem amount.

On occasion, travelers may be unable to find a hotel at a rate that does not exceed the maximum federal lodging per diem rate for the location of travel. If that occurs, travelers must obtain prior approval (see Over-the-Max Lodging Requests). Whenever possible, agency sponsored conferences should be arranged at facilities honoring the federal per diem rates for meals and lodging. When meals and lodging are provided as a part of an agency sponsored conference or event, additional reimbursement is not permitted.

Over-the-Max Lodging Requests

The Office of the State Comptroller's Bulletin G-180 extends to Agency Chief Fiscal officers the authority to approve exceptions to standard travel rates when deemed necessary. On this campus, review for pre-approval of over-the-maximum lodging requests are performed by the Associate Director of Purchasing and Accounts Payable after approval by the traveler's supervisor. The department/office must receive final approval PRIOR to booking the hotel room. All requests (including justifications) must be made in writing BEFORE the trip.

Personal Car Mileage

Per the OSC Travel Manual, "If available, State vehicles should always be considered when the use of an automobile is required."

Hierarchy of Vehicle Usage Flowchart

OGS Trip Calculator How-to Video

3 Options for SUNY Cortland Employee Travelers:

- If the department has designated fleet vehicles assigned to it, a fleet vehicle should be used as the mode of transportation.

- If a fleet vehicle is unavailable, then option 2 or 3 may be used.

- Use a rental vehicle using the New York State contract. The traveler will be reimbursed for the cost of the rental and fuel used.

- Non-employees may ride in a NYS rented vehicle only if on official state business with the state employee renting the vehicle. It is important to formally establish the official business nature of the travel prior to departure by completing a fully approved Travel Authorization Form. A non-employee classification would fall into one the below categories:

- leave status

- student status

- Research Foundation employment status

- volunteer status

- campus visitor status

- Insurance

- The rental company must provide New York statutory liability limits of insurance in the amount of $25,000/$50,000/$10,000, plus statutory uninsured motorists a no-fault coverage.

- Neither you nor your employer are authorized to purchase any additional insurance when renting a vehicle in New York State.

- In the event of a serious accident where the basic limits are exhausted, the State employee would be defended and indemnified under Section 17 of the Public Offenders Law subject to the conditions contained therein.

- If the rental vehicle is damaged, the State is responsible for a maximum of $100 to private passenger vehicles (including mini vans) and full value for commercial vehicles such as large vans and trucks. In the event you pay the $100, OGS will reimburse you through the Bureau of Insurance, with appropriate documentation.

- Rentals should be compact or standard/mid-size with justification included with reimbursement paperwork. If you feel that you need a larger vehicle (due to multiple passengers, etc.), please contact the Travel Administrator at x2306 for prior approval and include justification. Failure to obtain prior approval will result in the traveler paying the difference of the larger vehicle out of their own pocket.

- Charges & Violations

The operator of a State rented vehicle is personally responsible for payment of any traffic violations, E-ZPass violations, and/or damage caused to the vehicle by careless and/or reckless driving while in possession of a State rented vehicle. - E-ZPass tolls can be paid with a p-card to the rental company.

- Any gasoline purchases/refills and other direct costs associated with the rental vehicle will be reimbursed with receipt or direct billed to the university. Reimbursement for personal car mileage when using a rental vehicle will not be allowed.

- Employees who utilize rental vehicles for personal use must reimburse the State for the cost of any charges incurred as a result of such personal usage.

- Non-employees may ride in a NYS rented vehicle only if on official state business with the state employee renting the vehicle. It is important to formally establish the official business nature of the travel prior to departure by completing a fully approved Travel Authorization Form. A non-employee classification would fall into one the below categories:

- Use a personal vehicle.

- If this option is selected, an OGS trip calculator form must be completed using the compact vehicle option to determine the lesser of travel reimbursement amount.

- Please note the insurance on the personal vehicle will be responsible for any claims should there be an accident.

Reimbursement for personal car mileage is made in accordance with the rates established by the employee's respective bargaining agreement, with some units basing reimbursement on the standard allowance established by the Internal Revenue Service. These rates change periodically and will be verified by the Purchasing and Accounts Payable Office when vouchered.

- Rates are updated annually on January 1st on the U.S. General Services Administration website.

To document personal car mileage for reimbursement, travelers must complete a Statement of Automobile Travel (Form AC160) detailing the mileage claimed and attach to the Travel Reimbursement Voucher.

Note the following excerpt from the published OGS Bureau of Insurance Guidelines regarding Conditions of Use of Personal Vehicles:

Conditions of use of personal vehicles for personnel authorized to use their personal vehicle on official State business, the following conditions and/or State coverage policies apply:

- There is no State coverage for:

- Uninsured/Underinsured motorists

- Personal Injury Protection

- Medical Payments

- These coverage policies must be provided through your own personal policy

- Workers' Compensation coverage is provided the same as if you were using a State-owned vehicle on State business.

- Comprehensive & Collision losses to the personal vehicle are not covered by the State.

- Liability to other persons, including your passengers must be covered by your own personal auto policy. If losses exceed your policy limit, the state will cover the excess liability under public officers law, section 17, article 2.

If you use your personal vehicle on a regular basis for State business you should contact your insurance agent or company to ensure that you are properly covered.

In accordance with the OSC Travel Manual, “Charges for gasoline, oil, accessories, repairs, depreciation, anti-freeze, towing, insurance, and other expenditures will not be allowed. These are considered operational costs and are covered in the mileage allowance.”

Receipt Requirements and Miscellaneous Travel Expenses

To be reimbursed for certain travel-related expenses, original receipts must be provided as follows:

| Expense type | Documentation |

|---|---|

|

Lodging |

Original receipt showing: a) Name(s) of the traveler(s) b) Name, address, and telephone number of lodging establishment c) Number of people in the room d) Rate paid e) Dates of occupancy NOTE: If lodging is shared, the name(s) of the other employee(s) must be included on the voucher and each employee must claim only their share of the actual lodging cost. If lodging is shared with a non-employee (i.e. spouse), the employee must document that the rate claimed is the rate for single room occupancy. |

|

Common Carrier (Bus, Train, Airplane) |

Original ticket passenger receipt detailing passenger name, travel dates, and amount of ticket |

|

Parking, Taxi, or Shuttle Fares |

Original receipt |

|

Rental Car |

Original receipt showing rental times |

|

Tolls - E-ZPass |

E-ZPass statement with charges highlighted |

|

Tolls - E-ZPass for Rental Car |

Should be paid with dept/office P-Card |

|

Gasoline |

Original receipt which lists the date, number of gallons purchased, name of the vendor, and amount |

|

Day Trip Meals (receipted) |

Original detailed receipt (itemized) |

|

Personal Mileage Reimbursement |

Requires the Personal Mileage Form (AC160) and OGS Trip Calculator |

Research Foundation Travel

Please reference Research Foundation Travel.

IMPORTANT: For any SUNY Cortland employee traveling for work, they must complete a Travel Authorization Request form (cortland.edu/travelauth) regardless of funding source. If funding source is RF, an RF Travel Authorization must be completed in addition to the SUNY Cortland Travel Authorization (meaning there will be two (2) travel authorizations for the one (1) trip).

Tax Exempt Status: In-State Lodging

When traveling within New York State on official business, lodging charges may be exempted from State and Local Sales taxes by presenting a Tax Exemption Certificate (Form ST 129 PDF) to the lodging vendor at the time of check-in. These certificates should be acquired prior to travel since reimbursement for sales tax is not allowed by OSC when lodging is secured within NYS.

Federal lodging per diem rates are now for room rates only and do not include taxes. When traveling outside of New York State on official business, reimbursement of actual costs paid for lodging taxes may be reimbursed to the traveler as a miscellaneous expense, subject to funding availability.

Travel Advances

Travel Advances are available, but are subject to final approval by the Travel Office (pending any required documents and/or account number to be charged).

What is covered under a Travel Advance?

- Advances only cover:

- Per diem costs for meals and/or lodging

- Airfare

- A travel advance should be limited to what can be reasonably estimated to be the traveler’s expected business travel expenses.

What are the Travel Advance limits?

- Maximum limit is $400 (not to exceed any funding limitations set by the traveler's department) for overnight trips.

- Per OSC Rules and Regulations (see Chapter XIII, Section 4.B "Travel Advance" from OSC's Guide to Financial Operations)

- Minimum limit is $75

Exceptions: Advances exceeding $400 may be approved in unusual circumstances, such as for international travel, but require specific justification and additional processing time.

Why is an account number needed for the Travel Advance?

- The funds must be encumbered against an account in the SUNY Financial Management System to ensure there is sufficient funding available to cover the estimated cost of the advance.

What do I need to submit for a Travel Advance?

- Required documentation to be included with your Travel Authorization Request:

- Conference/meeting agenda (if asking for meals)

- Hotel confirmation (if asking for lodging)

- Airfare receipt (if asking for airfare)

How do I know if I'm getting my Travel Advance or not?

- Review any notes from the Travel Administrator on your approved Travel Authorization Request Form. A Travel Authorization may be approved, but if any of the required documentation is missing, the advance will not be given.

- Advances will be issued by the Travel Office approximately three (3) days before the departure date unless otherwise communicated.

- Travel Authorizations requesting an advance must be received at the Travel Office level (be sure your travel authorization is not stuck with one of your approvers) for approval at least two (2) weeks prior to travel for meal & lodging advance requests and at least four (4) weeks for advances that include airfare.

*If you have not received your final approved travel authorization prior to your trip, please check with the Travel Office at travel@cortland.edu.

When should I submit my Travel Voucher?

- Preferably within two (2) weeks of returning from their trip, but no later than 30 days upon return, the traveler must submit a Travel Voucher (including any supporting documentation) to the Travel Office.

- The Travel Voucher must include the amount of your travel advance to be deducted from your total to be reimbursed.

How can I submit my Travel Voucher and backup paperwork to the Travel Office?

- Option 1: Scan & email everything to travel@cortland.edu (highly preferred).

- Option 2: Send via interoffice mail to: Attn: Travel Office, Miller Bldg, Room 310.

IMPORTANT: Electronic/digital signatures are not acceptable on State forms (i.e., Travel Voucher). (See Signature Types)

What if my final paperwork is delinquent?

- Failure to account for the advance within the 30-day period upon your return will result in the outstanding amount being considered delinquent, which can lead to the sum being deducted from the employee's wages and the denial of future travel advances.

What if my Travel Advance was more than I actually spent?

Repayment of Excess Funds

The traveler is fully liable for repayment of any and all advance amounts that exceed the actual cost of your requested funding.

- If the advance received was more than the actual approved expenses, the traveler must submit a check for the difference along with the completed Travel Voucher within 30 days of returning from their trip.

- Checks must be made payable to: SUNY Cortland.

Travel Per Diem Rates

Per diem rates are established by the U.S. General Services Administration (GSA). A full per diem is considered to be dinner the first day, and lodging and breakfast the following day.

Lodging & meal allowances are calculated based on location.

- Lodging

- Use the month of stay and your lodging location (which may be different than where the conference/meeting is located).

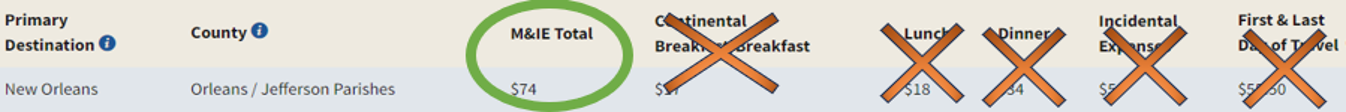

- Meals

- Use M&IE Total column amount

- SUNY Cortland uses an 80/20 breakdown for dinner & breakfast

- For example: $74 M&IE Total

- Breakfast = $15.00 (20%)

- Breakfast on day 1 only if traveler leaves at/before 7:00 AM.

- Dinner = $59.00 (80%)

- Dinner on last day only if traveler returns at/after 7:00 PM.

- Breakfast = $15.00 (20%)

- For example: $74 M&IE Total

- SUNY Cortland uses an 80/20 breakdown for dinner & breakfast

- Use M&IE Total column amount

Note: Incidental expenses such as tips, etc., continue to be included in the per diem allowance.

Look up Per Diem Rates within the continental U.S.

- GSA only sets rates for the 48 contiguous states and the District of Columbia.

Look up Per Diem Rates for Alaska, Hawaii, and U.S. Territories set by the Department of Defense

Look up Per Diem Rates for foreign destinations set by the State Department

Travel Reimbursement

Per New York State, within 30 days of returning from their trip, the traveler must submit a travel voucher (including any supporting documentation).

Per OSC, "A traveler should only be reimbursed for expenses related to a business event. When a traveler decides to extend his or her stay either before or after the business event, those expenses should not be reimbursed."

- The traveler (or department/office Administrative Assistant) completes a Travel Voucher (AC 132-S), attaching all receipts for lodging, tolls and miscellaneous expenses, registration fees, airline tickets, etc. along with a copy of the program brochure, and agenda, if applicable, for any conference attended.

- If personal car mileage (PCM) reimbursement is claimed, the traveler completes and attaches the Statement of Automobile Travel (Form AC 160) to the Travel Voucher along with the OGS Trip Calculator.

- The traveler must indicate if a travel advance had been issued for the vouchered trip and record that on the Travel Voucher.

- The traveler signs, indicates official station and the correct home address (see HR if you need to update this in the SUNY system), and forwards the Travel Voucher and attachments for supervisory approval and signature.

- The supervisor indicates the approved reimbursement amount and account number to be charged on the Travel Voucher, signs and, if needed, forwards to the appropriate Dean or VP for signature and account coding if funding is being provided by those areas.

- Reimbursements will be delayed if any signatures are electronic, digital, or missing. In such cases, the documents will be returned to the traveler for correction and resubmission.

- The Travel Voucher and backup information can then be scanned and emailed to the Travel Office at travel@cortland.edu (be sure to include both front and back of pages).

- The Travel Office reviews the Travel Voucher in accordance with guidelines set forth in OSC Bulletin No. G-180.

Travel Reimbursement to Non-State Employees and Students

Travel reimbursements to non-employees are processed via a New York State Standard Voucher (PDF). The Standard Voucher should contain the complete name and home address of the person being reimbursed and the description block should specify the exact purpose for the payment including dates of the activity.

The payee's signature must be entered in the Payee Certification block on the voucher. Effective February 1, 1994, all travel reimbursements to non-employees must be via the Receipted Method guidelines, which require itemized receipts for lodging and meals. All original receipts should be attached to the Standard Voucher and forwarded for appropriate approval signatures and processed by Accounts Payable.

Reimbursement of student travel expenses may also be made via a Standard Voucher utilizing the same guidelines listed above if the student is attending an officially authorized event or other official University business. Original receipts and appropriate signatures and a justification describing the travel as official and necessary must accompany the voucher for reimbursement. A travel authorization must be submitted for the student(s) as well prior to traveling.

- Application for use of a state vehicle by a student driver must be processed through the Transportation Office.

- State-owned vehicles may be used for transporting students only for the purpose of field trips required for an instructional or research program or to intercollegiate competitions in such fields as athletics, speech, music and drama, and other social, recreational, cultural and educational programs authorized by the chief administrative officer or his/her designee, provided such events are accompanied by a member of the campus staff.

- Students will be assigned to drive State cars only when it is not feasible to use another driver. Separate authorization for the use of a student driver must be made for each trip.

- All designated drivers must have a valid New York State driver's license.

- Approval for use is given by the Transportation Office and the chief administrative officer/designee.

Use of State Vehicles

Hierarchy of Vehicle Usage Flowchart

As outlined in the NYS Travel Manual, a traveler should make every effort to use the most efficient and cost effective method of transportation available and is in the best interest of the State. If the department has designated fleet vehicles assigned to it, a fleet vehicle should be used as the mode a transportation. If a fleet vehicle is unavailable, please use the OGS Trip Calculator to determine whether a personal or rental vehicle is the most economical means of ground transportation to use.

State University of New York and SUNY Cortland set forth the following requirements for use of State-owned vehicles:

Eligibility

- Must be used only for official University business.

- The driver must be a New York State employee (see 7, 8 below) except when special provisions are agreed to for student drivers (see below).

- The driver must hold a valid N.Y.S. driver's license and accept responsibility for adherence to all vehicle and traffic laws.

- All passengers must be on official University business.

- Personal or unrelated travel may not be combined with official business travel.

- Duration of travel normally should not exceed three days and the cost of extended parking (airport, etc.) should not be excessive.

- State-owned vehicles may not be used by affiliated organizations unless all of the above requirements are met, including the requirement that the driver be a NYS employee. Cost reimbursement, however, may be from a non-state source.

- If formally appointed as a volunteer, a person is considered to have met the NYS employee requirement.

- The University is reimbursed at the prevailing per mile rate as a Recharge to University departments by journal to IFR accounts or by invoicing to affiliated organizations.